Companies with the best and the worst fundamentals.

Lists of companies in NSE500 with the best and the worst fundamentals...

Lists of companies in NSE500 with the best and the worst fundamentals...

List of the latest important filings for NSE500....

Lists of companies in NSE500 with the best and the worst technicals...

An analysis of JPMorgan Chase's $105 billion 2026 expense guidance, exploring its...

An investor-oriented article synthesising corporate leaders’ optimism for 2025 and the top...

An investor-focused analysis of major shifts in the financial services landscape as...

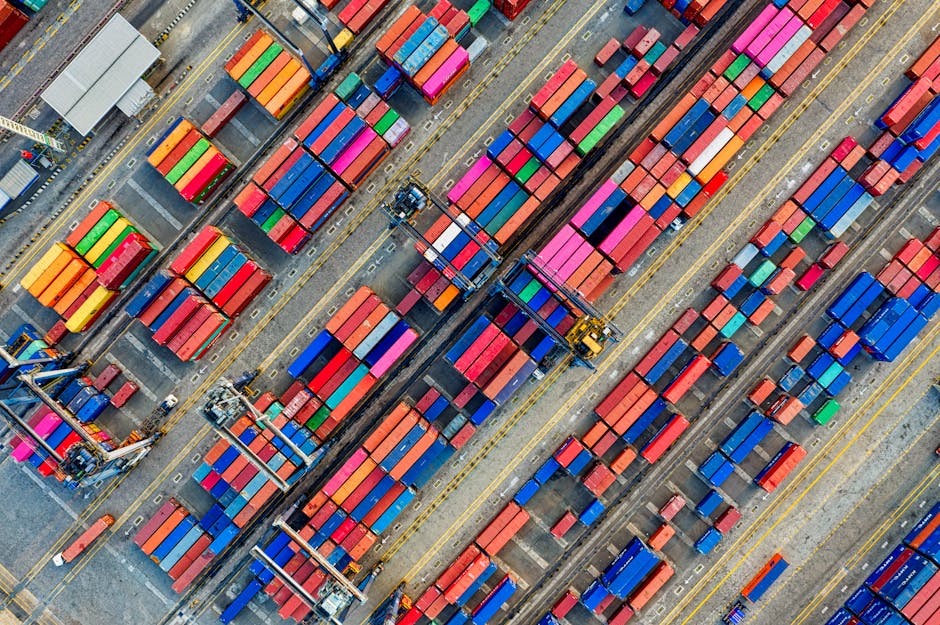

In late 2025, two major geopolitical developments have begun to reshape the contours of global trade, supply chains, and corporate investment strategy. First, a de-escalation in the U.S.-China trade dispute has yielded an extended “ceasefire” of tariff and export restrictions, offering temporary stability to markets that have endured years of disruptive tit-for-tat barriers. Second, meaningful progress in peace negotiations over the Russia-Ukraine war culminating in recent consultations in Berlin has introduced the prospect of a negotiated settlement that could gradually alter energy, agricultural, and mineral flows across Eurasia. These parallel shifts, though neither fully resolved nor without risk, are prompting investors and companies to reassess long-standing assumptions about where and how global value chains will operate in 2026 and beyond.

On the U.S.-China front, talks between President Donald Trump and President Xi Jinping in late October 2025 produced a substantive trade truce after months of heightened tensions. The agreement included suspension of planned tariff escalations most notably averting a threatened 100% duty on Chinese goods and a one-year pause on China’s expanded export controls affecting rare earth minerals and critical components. These measures had previously raised alarms across manufacturing and defense supply chains due to China’s dominant share of production for elements used in electric vehicles, semiconductors, and advanced military systems.

This temporary cessation of hostile trade measures has already begun to ease cost pressures in sectors dependent on inputs previously constrained by export restrictions. For instance, export volumes of strategic magnet materials to the United States surged markedly in mid-2025 following the easing of export curbs earlier in the year, demonstrating how even tenuous diplomatic progress can materially affect supply availability.

In agriculture, the truce has signaled a potential reversal in export patterns that had weighed on U.S. farmers for much of the year. Historically reliant on Chinese purchases of soybeans and other row crops, American producers faced declining demand as Beijing diversified toward South American suppliers amid tariff retaliation. The renewed commitments from China to resume substantial soy-bean imports have bolstered expectations that 2026 will see a normalization of agricultural trade flows, providing relief to a sector that has been heavily exposed to tariff risk.

In parallel, incremental progress in Russia-Ukraine peace negotiations has provided fresh impetus for stakeholders to contemplate post-conflict market restructuring. Recent talks held in Berlin brought U.S. and Ukrainian representatives together to advance proposals towards a settlement, including substantive discussions over security arrangements and territorial parameters. Ukrainian President Volodymyr Zelenskiy’s willingness to adjust long-standing strategic objectives such as de-emphasizing NATO membership in exchange for binding security guarantees signals a potential shift in diplomatic postures that could pave the way for broader peace frameworks.

Although these discussions remain preliminary and fraught with unresolved issues, their very existence has stirred considerations about the future of energy and commodity flows. A negotiated ceasefire, for example, would gradually reduce volatility in European energy markets that have been dominated by uncertainty over Russian natural gas exports and European reliance on alternative LNG supplies. Investors have noted that a credible peace process could eventually stabilize or even moderate energy prices that surged at various points during the conflict, affecting earnings prospects for majors across the energy sector.

More strategic still is the potential role of Ukraine’s natural resources in reshaping critical mineral supply chains. Although significant extraction and processing infrastructure is currently undeveloped, geological surveys indicate that Ukraine holds substantial reserves of manganese, titanium, and graphite materials essential for steelmaking, batteries, and other industrial uses. Additionally, identified deposits of lithium and other rare earth-adjacent minerals suggest latent potential that could, over time, reduce Western dependence on East Asian and Chinese supply hubs. Turning these opportunities into reality would require significant capital, stable security conditions, and multi-year investment commitments, yet the current diplomatic momentum has emboldened some investors to consider long-range exposure to Ukrainian resource development.

The twin geopolitical developments have uneven effects across sectors, creating both risks and openings for corporate strategy in 2026.

One of the most tangible beneficiaries of the U.S.-China truce is the global agricultural sector. U.S. soybean, corn, and sorghum exporters, in particular, can expect more predictable demand from China, reversing trade patterns that had shifted heavily toward Brazil and Argentina in recent years. Such stabilization bodes well for companies with integrated export infrastructures, grain elevators, and logistics networks, offering a more predictable pricing and distribution landscape after seasons of tariff-induced volatility. Longer-term, diversified agricultural trade flows may also encourage investments in agricultural tech, storage capacity, and port infrastructure to capture improved export volumes.

Key manufacturing sectors ranging from electric vehicles to consumer electronics and defense systems stand to benefit from improved access to rare earth elements and related inputs. China’s suspension of tightened export controls provides Western firms breathing room to source essential materials without immediate supply interruptions. However, strategic analysts caution that the underlying imbalance in rare earth supply remains unresolved; China still dominates mining, processing, and magnet production, and long-term resilience will require diversification strategies, including investments in alternative mining jurisdictions, recycling programs, and processing capabilities outside China.

For energy companies, the peace negotiations offer the promise though not yet the guarantee of a normalization of flows that have been disrupted by conflict and sanction regimes. European utilities and industrials, long challenged by the specter of Russian gas disruptions, may adjust capital allocation toward infrastructure that balances diversified LNG supply with pipeline capacity. In the near term, energy price volatility may persist as discussions evolve, yet a durable peace framework could eventually dampen risk premia in European energy markets.

The defense sector remains acutely sensitive to both geopolitical contexts. While a peace process might temper some near-term demand for conflict-related military equipment, persistent geopolitical competition and residual uncertainties in Russia-Ukraine relations will likely sustain defense spending commitments in North America and Europe. Additionally, the prolonged importance of secure supply chains for advanced systems especially those reliant on rare earth elements suggests continued investments in technologies that reduce strategic vulnerabilities. Companies at the nexus of defense production, materials science, and supply chain analytics may find their offerings increasingly central to national security planning.

From the vantage point of late 2025, the extended U.S.-China trade ceasefire and progress in peace talks underscore a broader theme: geopolitical risk is now central to corporate investment decisions. Firms are recalibrating supply chain footprints, sourcing strategies, and long-range capital plans in response to shifting policy landscapes. Many multinational corporations are adopting “China+1” approaches diversifying manufacturing to Southeast Asia, India, and Mexico while simultaneously engaging in supply chain mapping to anticipate and mitigate disruptions. Similarly, investors are weighing exposure to regions poised to benefit from stabilization, such as agricultural exporters and companies developing alternative mineral sources.

As these geopolitical developments continue to unfold, they will shape where, how, and at what cost companies build resilience and pursue growth. The interplay of diplomacy, trade policy, and strategic sourcing will remain a defining feature of corporate strategy into 2026 and beyond.

An article exploring Oracle’s latest quarterly results that reveal a significant AI...

An in-depth article analysing the Federal Reserve’s December 2025 rate cut and...